The U.S. stock market is a vital component of the global financial system, serving as a network where individuals and institutions participate in buying and selling shares of publicly listed companies. This marketplace plays a crucial role in helping businesses raise capital to fund expansion and innovation. In this blog, we’ll delve into the dynamics of the US stock market and highlight how platforms like Tiger Brokers facilitate seamless trading experiences.

The US Stock Market: A Hub of Financial Activity

The US stock market is one of the largest and most influential financial markets worldwide. It consists of multiple exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, where a vast array of company shares are traded. These exchanges provide a structured platform where investors can buy and sell shares in a regulated and secure environment.

Capital Raising and Expansion: Companies list their shares on the stock market as a means to access capital from the public. This capital is typically used to fund various aspects of their operations, from expanding production facilities to entering new markets or developing new products. By selling shares, companies dilute ownership among a broader pool of investors but gain the necessary funds to propel their growth and enhance their competitive stance in the market.

Liquidity and Price Discovery: The stock market is instrumental in providing liquidity, allowing investors to buy and sell shares with relative ease. This liquidity is crucial for the functioning of a healthy financial market, as it ensures that investors can quickly convert their investments into cash. Furthermore, the stock market facilitates the process of price discovery, where the prices of shares are determined through supply and demand dynamics, reflecting the collective valuation of a company by all market participants.

The Role of Brokerages

Brokerages play a vital role in the stock market by facilitating the buying and selling of stocks. They act as intermediaries between investors and the exchanges, providing the tools and services needed to execute trades efficiently. Modern brokerages offer a range of services including, but not limited to, trading platforms, financial analysis tools, and customer support.

Tiger Brokers: Enhancing Your Trading Experience

As the discussion of the US stock market unfolds, it’s important to recognize the role of advanced trading platforms like Tiger Brokers that streamline the process for investors. Tiger Brokers, a leading brokerage firm, offers a robust platform that caters to both novice and experienced traders looking to engage with the US stock market.

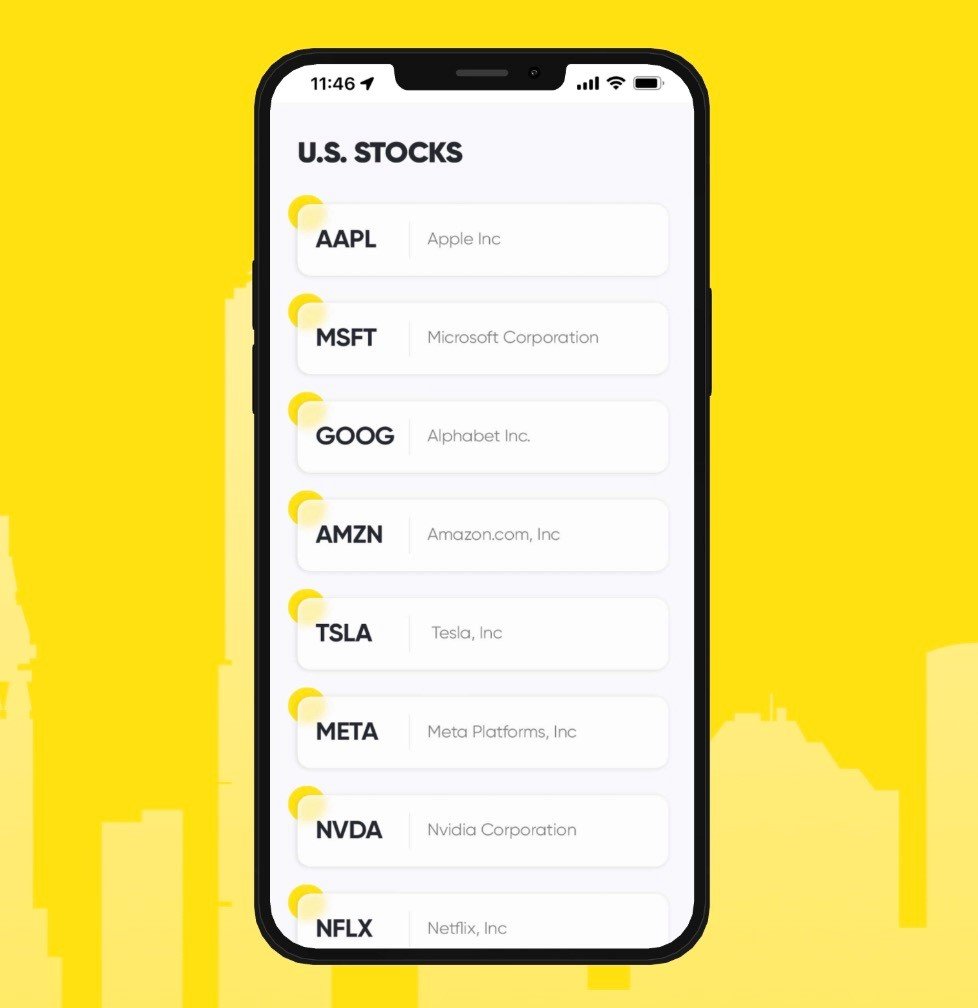

Technological Edge: Tiger Brokers utilizes cutting-edge technology to ensure that users can trade efficiently and effectively. The platform provides updated data, analytical tools, and a user-friendly interface, all of which enhance the trading experience.

Access and Convenience: With Tiger Brokers, investors have access to a wide range of stocks listed on major US exchanges. The platform’s mobile and desktop applications allow traders to manage their portfolios from anywhere at any time, aligning with the needs of today’s mobile-first world.

Support and Resources: Tiger Brokers also places a high priority on educating its users. The platform offers educational resources and support to help investors make informed decisions. This is crucial in the complex and often volatile environment of stock trading.

Conclusion

The US stock market is a cornerstone of the global financial landscape, providing a platform for companies to raise capital and for investors to participate in the financial growth of these companies. As the market evolves, the role of brokerages like Tiger Brokers becomes increasingly significant. With its advanced technology, comprehensive access to US stocks, and dedication to client education, Tiger Brokers is ideally positioned to help traders navigate the complexities of the stock market. Whether you’re a seasoned investor or just starting out, Tiger Brokers offers the tools and insights needed to engage with the US stock market effectively.